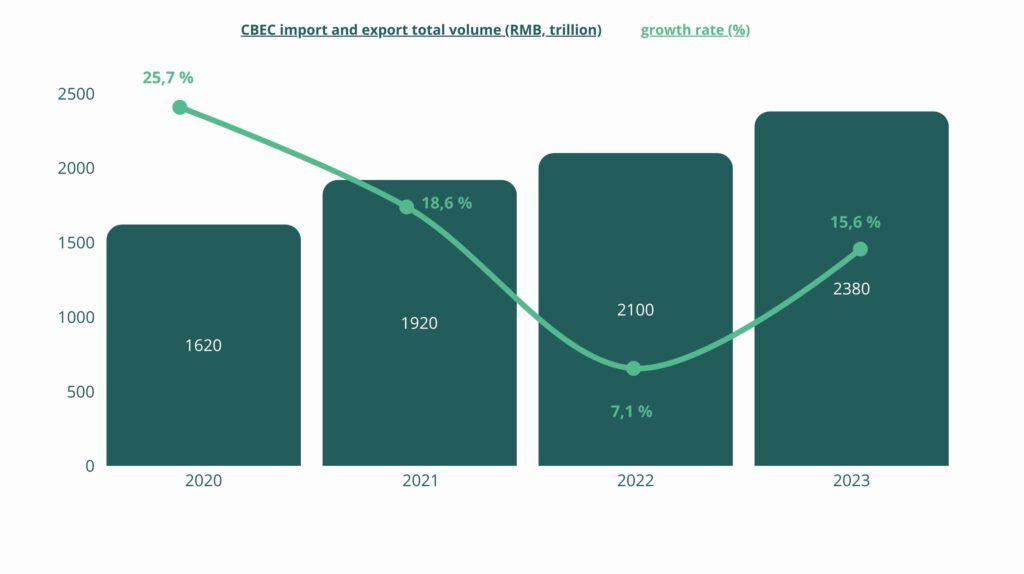

China’s cross-border e-commerce (CBEC) sector – online trade between Chinese consumers and foreign sellers – has become a cornerstone of the country’s foreign trade. In 2023, China’s CBEC import-and-export volume reached RMB 2.38 trillion (about US$331 billion), a 15.6% jump year-on-year. This growth was driven largely by a 19.6% surge in exports, with imports up 3.9%. The chart below illustrates China’s rising CBEC trade value.

Figure: China’s CBEC import-export value (RMB trillion) 2020–2023.

Cross-border e-commerce in China includes both imported goods sold to Chinese consumers and Chinese exports sold abroad. It is now mainstream: a 2024 study found 188 million Chinese shoppers bought imported products online (nearly double the number five years earlier). About 80% of urban consumers have bought goods via CBEC platforms. Put simply, CBEC is a major sales channel for foreign brands targeting Chinese buyers, offering streamlined customs and tax breaks. For example, under China’s CBEC retail import program most on-list purchases below ¥5,000 (~$730) are duty-free, significantly reducing total costs. Given the market’s scale – China accounted for roughly half of global e-commerce sales by 2023 – understanding its structure and trends is vital for Western exporters.

2024 Recap & 2025 Trends

China’s CBEC growth resumed after COVID disruptions: imports +exports volume climbed 15.6% in 2023, rebounding from slower gains in 2022. For context, CBEC trade expanded by only 7.1% in 2022, so 2023’s jump highlights ongoing momentum. Exports continue to outpace imports (2023 saw exports of RMB1.83T vs imports ~RMB0.55T). As 2025 approaches, analysts expect continued growth in cross-border channels, driven by China’s economic reopening and stable demand for imported goods. Major trends include: improved logistics, richer product selection and new sales channels.

- Social and Livestream Commerce: China leads in livestream shopping. Live-hosted product demos have become ubiquitous: domestic marketplaces (Taobao Live, Kuaishou) and social apps (like Douyin, the Chinese TikTok) are expanding cross-border offerings. Notably, Douyin launched its own imported goods store in 2023, curating global products for Chinese buyers. This means brands can now sell via social media apps as well as traditional e-tail sites.

- Premiumization and Quality Focus: Chinese consumers are increasingly demanding higher-quality overseas brands. A JD.com/Nielsen report (mid-2024) found 56% of CBEC shoppers cite product quality (and origin) as their top purchase criterion, and over one-third expanded their import spending last year. Cosmetics, health supplements, baby formula and specialty foods are especially popular. In general, expect premium health, beauty and nutrition products to lead CBEC growth, as consumers trade up for safety and prestige.

- Technology and New Business Models: E-commerce in China is highly digital and data-driven. We expect more use of AI for product recommendations and personalized marketing in CBEC. “Interest-based” algorithms will match foreign products to niche Chinese tastes. Meanwhile, green logistics and faster customs clearances will be promoted. Companies should also watch for new cooperative trade initiatives like “Silk Road E-commerce” under the Belt & Road project, which may open additional cross-border routes.

- Domestic Competition and Global Expansion: Chinese cross-border platforms themselves are globalizing (e.g. Temu and Shein abroad), but domestically they face competition too. New entrants and aggressive pricing (enabled by subsidies) mean foreign sellers must differentiate. On the upside, as Western sanctions on Russia grow, China’s CBEC remains relatively open – a policy advantage in 2024.

In summary, the CBEC market is upgrading and diversifying. Platforms are integrating (traditional e-tail, social, group-buying, livestream), and consumers expect smoother, end-to-end service. Global sellers should prepare for an ecosystem where Chinese buyers increasingly book imports online as a normal part of shopping, often via mobile apps.

Government Policies & Pilot Zones

The Chinese government strongly supports CBEC as a trade booster. Key policies include duty/VAT incentives, simplified customs clearance, and dedicated CBEC pilot zones. For example, sales on China’s official CBEC import list can often be tax-exempt or subject to only 70% of normal VAT/tariff. Notably, in 2019 China raised the duty-free threshold to ¥5,000 per order (¥26,000 annually), and regulators periodically expand the approved import categories (the “positive list”). In 2022, 29 new product categories (from cosmetics to nutrition) were added to the CBEC import list, broadening access for foreign brands.

China also designated hundreds of CBEC Pilot Zones and “pilot cities” with extra perks. These special economic zones (e.g. in Shanghai, Hangzhou, Hainan) offer streamlined registration, bonded-warehouse facilities, unified e-pay and data-sharing systems. By late 2023 the State Council had approved 165 comprehensive CBEC zones nationwide. Businesses operating in these zones enjoy reduced tariffs and pre-clearance of goods, making delivery to consumers faster and cheaper. (For instance, Alibaba’s Tmall Global already stocks ~70% of its cross-border inventory in domestic bonded warehouses, enabling next-day delivery on over half its orders.)

Other supportive moves include easier refunds (a pilot for across-zone returns was launched in 2023 ) and digital services (e.g. online VAT filing). China’s Belt & Road e-commerce forum also encourages firms to sell in emerging markets, building customs/logistics hubs along trade routes. In short, policy tailwinds (lower taxes, more zones, tech platforms) make CBEC an attractive channel. Entrepreneurs should monitor Chinese announcements closely, as rules evolve (for example, if import quotas tighten, it could affect pricing).

Key Platforms and Sectors

China’s CBEC ecosystem is anchored by a few large platforms and vibrant product niches. Leading cross-border marketplaces include:

- Alibaba’s Tmall Global: The flagship international marketplace for imported goods. Launched in 2014, Tmall Global now hosts over 46,000 foreign brands from 90+ countries. It serves more than 100 million customers (and growing). Tmall Global integrates with Alibaba’s logistics (Cainiao) and payment networks, pre-positioning much inventory in bonded warehouses for fast delivery.

- JD Worldwide: The cross-border arm of JD.com. JD offers a rigorous logistics network and often faster delivery, appealing to middle/upper-class consumers.

- Little Red Book (Xiaohongshu): A social-platform-turned-shopping-channel. Brands use it to reach younger, trend-conscious consumers via influencer content. Xiaohongshu’s cross-border sections (and now direct buying channels) are strong for beauty and lifestyle goods.

- Douyin (抖音): China’s version of TikTok has rapidly expanded into shopping. Its new import store and live-sales features let brands reach China’s 800 million+ short-video users.

Major product categories dominate these platforms. Nearly all CBEC imports are consumer-oriented. By one analysis, the top four import categories are beauty and personal care (~28% of CBEC imports), food and produce (~15%), pharmaceuticals/medical (~14%) and infant formula and baby products (~13%). (For example, China is the world’s largest infant formula market, worth ~$17B in 2024.) A recent white paper confirms the favorites: skincare/cosmetics, nutrition and health supplements, maternal/infant care, and specialty foods/beverages account for the bulk of CBEC purchases. Shoppers also seek niche or professional products – e.g. high-end electronics, small appliances, or sports gear – drawn by foreign brands’ technical edge. In practice, European wine, Australian dairy (like Blackmores vitamins), and Gulf luxury goods (perfume, gold) all find buyers via CBEC.

List: Key Platforms and Leading Categories

- Major Platforms: Alibaba Tmall Global, JD Worldwide, Xiaohongshu (Little Red Book) and social channels like Douyin. Larger platforms (Tmall, JD) handle ~80% of CBEC traffic.

- Top Categories: Skincare & cosmetics; vitamins and health supplements; maternal & baby products (especially formula); gourmet foods and wines; and consumer electronics/fashion (including luxury apparel).

Together, these platforms and sectors create entry points for global sellers. Tapping them effectively (for example, by opening a Tmall Global flagship store or collaborating with top influencers on Xiaohongshu/Douyin) is essential to reach Chinese consumers.

Buying Behaviors of Chinese Consumers

Chinese CBEC shoppers are digital-savvy and quality-driven. The middle class now treats imported online shopping as routine. Younger consumers (especially Gen Z) pursue niche, premium and personalized products. According to JD’s NielsenIQ study, 80% of urban consumers expressed interest in buying imports, and over one-third increased their import spending in the past year. In practice:

- Quality and Safety: Consumers overwhelmingly cite product quality as the reason to buy foreign brands. In fact, 56% said quality/origin is their top priority. High trust in platforms makes shoppers more adventurous: many try new categories (home appliances, pet care, functional foods) if they’re confident in the source..

- Frequent and Mobile Shopping: CBEC is almost entirely mobile. Chinese consumers make purchases on apps (WeChat mini-programs, Taobao, JD, etc.) and share product info via social media. A Nielsen report found consumers increasingly rely on influencers and reviews to discover foreign products. They often combine purchases – e.g. adding a skincare item in the same order as electronics to meet price thresholds.

- Diverse Interests: Shoppers have broadened beyond the old favorites (infant formula, cosmetics). Last year, 35–36% of CBEC users diversified the types of products they buy. Rising demand was noted in home appliances, fashion, alcohol, and pet products. In short, demand is maturing: routine household items and lifestyle goods from abroad are increasingly accepted.

- Wealthy and Seasonal Spenders: In wealthy regions (first-tier cities and affluent provinces), consumers spend more per order and expect luxury options. Seasonal peaks now include traditional shopping festivals (Singles’ Day Nov 11, “618” mid-year sale) as well as Western holidays (e.g. Christmas) due to foreign goods promotions.

Overall, Chinese online buyers in CBEC are looking for value (premium products at competitive prices) and convenience (fast delivery, easy returns). Brands that build digital engagement – via bilingual content, livestream demos, and responsive service – will succeed.

Market Entry Tips for Foreign Brands

For foreign businesses eyeing China’s market, CBEC offers a relatively low-barrier entry into China’s consumers. Key steps include:

- Choose the Right Platform: Decide between flagship marketplace stores (Tmall Global, JD Worldwide) or niche channels. Tmall Global is ideal for well-known brands targeting broad audiences, while JD Worldwide’s strength is logistics. Emerging channels like Xiaohongshu or Douyin can reach lifestyle audiences. Research each platform’s audience and fees before launching.

- Business Registration: You do not need a Chinese legal entity to sell on CBEC platforms. You must register your foreign business (with company/license documents) and designate an importer/account-manager. Many platforms also require a dedicated import-export license or a Chinese “endorsement” partner to handle customs filings.

- Compliance and Certifications: Ensure products meet Chinese standards. Regulated items (food, cosmetics, infant formula, health supplements) generally require registration with Chinese authorities (NMPA, CIQ) even for CBEC. Work with experienced agents to complete any mandatory filings. Also adapt packaging and labeling to Chinese language and safety rules. Non-compliance can lead to customs seizures or fines.

- Use Bonded Warehousing: To offer competitive delivery (often next-day in major cities), consider pre-shipping inventory to a Chinese bonded warehouse. This lets you market products as “in-stock in China” (fast, low-cost shipping) and qualify orders for CBEC tax breaks. Many platforms assist with connecting sellers to bonded logistics providers.

- Localize Marketing: Translate product descriptions accurately into Chinese. Tailor marketing campaigns to local tastes – for example, emphasize halal certification when targeting Gulf consumers. Leverage Chinese social media and Key Opinion Leaders (KOLs) for promotion. Many brands find success with WeChat or Douyin ads and livestreamed “unboxing” or tutorial sessions.

- Payment and Customer Service: Offer China-friendly payments (Alipay, WeChat Pay, UnionPay) to reduce friction. Provide customer support in Chinese (even via chatbots or hired staff). Efficient after-sales (refunds, exchanges) builds trust – China values hassle-free return policies.

- Test and Scale: Start by targeting a single region or product line. Use data analytics (provided by platforms) to track sales performance. Refine pricing and offerings based on feedback. Once a product proves popular, expand inventory. Remember that Chinese shoppers love variety, so regularly rotate promotions and bundle deals.

By following these steps, foreign brands can tap into China’s dynamic online market while managing risk. Notably, platforms themselves encourage this: Alibaba and JD actively run “flagship store” programs that simplify setup for foreign companies. Leveraging these official channels (and any government CBEC incentives) will accelerate market entry.

Gate Kaizen is the trusted partner of large and mid-cap companies as a provider of market entry services and HR Solutions in the Chinese market. We help your business save the outsantding costs of setting up your local entity by leveraging our own structure and the shortcuts of the digital era to minimize the financial risks of expanding overseas. This way, you can focus your attention on what really matters: your business.

Risks and Challenges

Despite its appeal, China’s CBEC market has challenges that foreign businesses must navigate:

- Regulatory Changes: Policies can shift. For example, CBEC tax exemptions (the ¥5,000 single-order limit) could be adjusted, affecting pricing. In fact, officials have noted that some countries are considering reducing small-package duty waivers. Any tightening of import quotas or bans on certain categories (e.g. data security restrictions on tech products) could require quick strategy changes.

- Intense Competition: You will face thousands of rivals, including domestic brands and other imports. Many Chinese and international players compete on price, often at thin margins. Differentiation is key – either by unique products, stronger branding, or superior service. Prepare to invest in marketing (ads, KOL promotions) to stand out.

- Logistics & Regional Variances: Delivery in China is generally fast in cities, but rural or inland regions can still be slow or costly. Estimate longer transit times outside urban hubs. Additionally, handling returns is complex and expensive; some foreign sellers see high return rates on lower-value items. Make sure your logistics partner or platform account can handle cross-border returns efficiently.

- Customs and Compliance Risk: Errors in customs documentation can lead to delays or confiscation. Platforms usually mediate, but mis-declaring an item’s value or category can trigger penalties. Likewise, counterfeits or misrepresented products (whether yours or scammers impersonating your brand) pose reputational risks. Ensure strict quality control and consider local trademark registration to protect your IP.

- Payment and Currency Exposure: The payment cycle in CBEC often relies on platform escrow. Foreign sellers should understand how and when funds (in RMB) are remitted. Exchange rate fluctuations can affect profitability. Be aware of China’s foreign exchange rules when repatriating earnings.

- Cultural and Communication Gaps: Misjudging Chinese consumer preferences (e.g. wrong product sizing, colors or marketing messages) can hinder sales. Language and service gaps also cause friction. Always use native speakers for key consumer interactions and adapt your branding for the Chinese market.

Overall, thorough preparation and local partnerships can mitigate these risks. Staying informed – via industry reports, platform notices and possibly a China-focused consultant – is crucial.

Strategic Outlook

China’s cross-border e-commerce market remains a bright spot in global trade. Robust 2023 figures and consumer surveys show that demand for imported goods is still rising, especially for quality, niche and lifestyle products. For foreign companies, China’s CBEC offers direct access to hundreds of millions of affluent shoppers with relatively low upfront investment.

The keys to success are clear: align with China’s CBEC frameworks (tax incentives, pilot zones, bonded logistics), adapt to local consumer tastes (premium quality, digital engagement), and use the right online channels (Tmall Global, JD, social e-tail, etc.). By leveraging the platforms and policies described above, foreign brands can establish a credible China presence without immediate local incorporation.

Looking ahead to 2025 and beyond, expect continued innovation: smarter cross-border logistics (even drone or blockchain tracking), deeper social-commerce integration (virtual shopping experiences), and gradual normalization of cross-border B2B trade under RCEP. Entrepreneurs who stay agile – monitoring policy tweaks and consumer trends – will be best placed to capitalize. In summary, China’s CBEC is no longer experimental but an essential part of the global e-commerce landscape. With careful strategy, it offers vast opportunities for international sellers.

How Gate Kaizen Can Help You Succeed in China’s CBEC Market

Navigating China’s cross-border e-commerce landscape requires more than just ambition—it demands a strategic partner with deep local expertise. At Gate Kaizen, we specialize in guiding businesses through the complexities of entering and thriving in the Chinese market.

Our comprehensive services encompass every facet of market entry:

- Pre-Entry Audit: We assess your business’s potential in China by analyzing the competitive landscape, market opportunities, and regulatory environment.

- Strategic Entry Plan: We craft a customized 3-5 year market entry strategy, aligned with your business’s development stage and long-term goals.

- Execution & Growth: We establish your local teams, launch online stores, and initiate sales, while providing ongoing operational reporting and performance insights.

By partnering with Gate Kaizen, you gain access to a dedicated team that understands the nuances of the Chinese market, ensuring your brand resonates with local consumers and complies with all regulatory requirements. Our goal is to minimize risks, optimize resources, and enable sustainable growth for your business in China.