Early after Donald Trump reelection for his second term, the U.S.–China trade tensions increased after the U.S. reignited the trade war with China: leading to new tariff hikes and export curbs pushed both sides into unprecedented territory, forcing a return to the negotiating table.

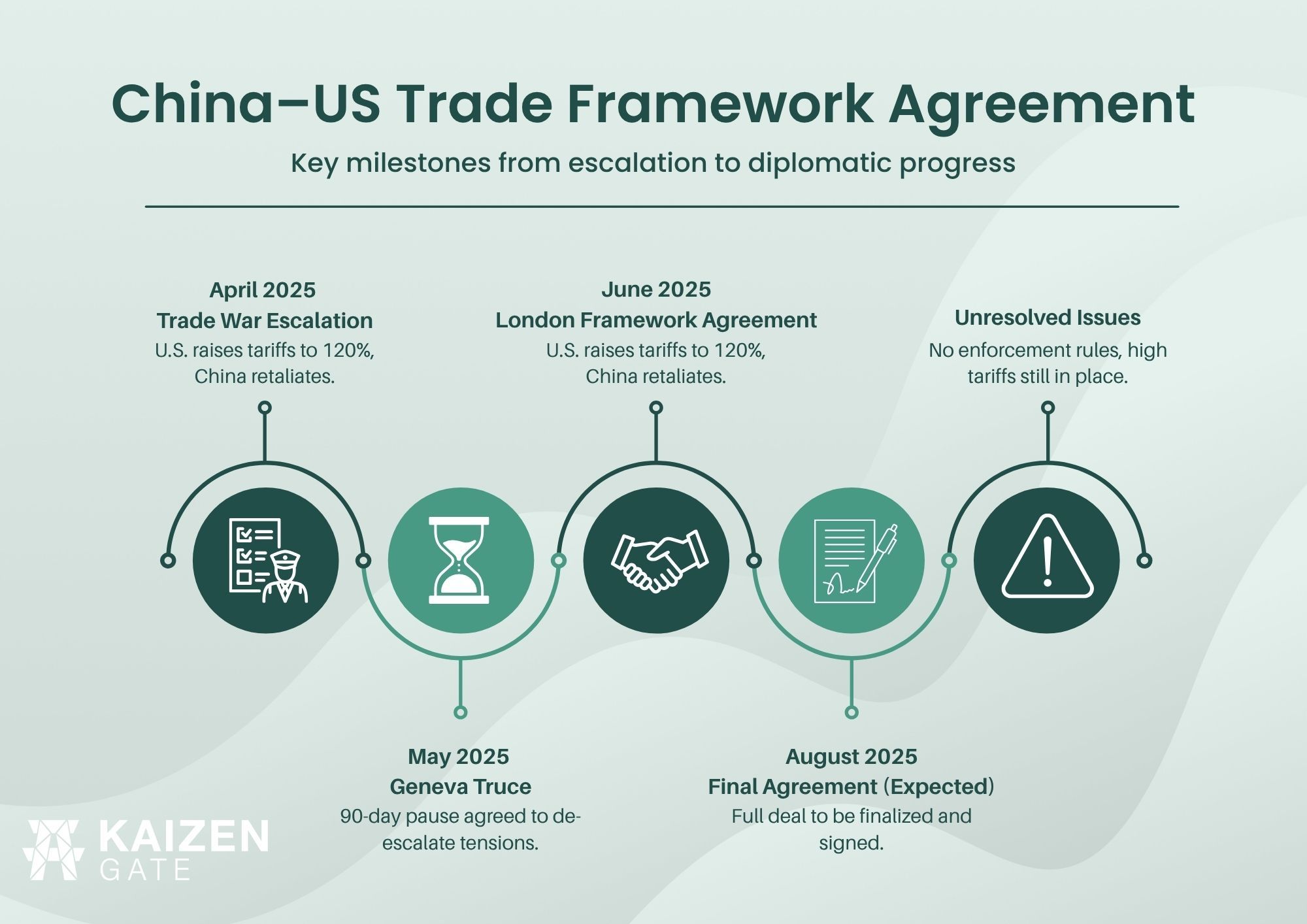

In spring 2025, negotiators met in Geneva and reached an initial “Geneva consensus” to halt the spiral. This produced a fragile tariff truce, and a 90-day pause on some measures, but ambiguities soon emerged. Each side accused the other of backtracking – Beijing imposed fresh limits on exports of critical minerals, and Washington pressed ahead with tech export bans. Tensions flared anew, threatening to upend the Geneva truce.

Facing mounting economic pain and global pressure, U.S. and Chinese delegations reconvened in London in June 2025 for marathon talks. After 20 hours of negotiations, they announced a preliminary framework agreement to restore calm and outline a path forward. This June 2025 framework – essentially a tariff truce paired with mutual concessions on strategic goods – is a significant, if tentative, step toward stabilizing the world’s most consequential trade relationship.

What the New Framework Agreement Includes

The June 2025 U.S.–China trade framework is a diplomatic breakthrough aimed at easing tensions. It focuses on four key areas: rare earth exports, high-tech export controls, visa and educational exchanges, and tariff levels. The table below summarizes the “before vs. after” changes under this framework:

| Trade Issue | Before June 2025 Framework (Trade War Climate) | After Framework (June 2025) – Proposed Changes |

| Average Tariffs | Sky-high, punitive tariffs: By April 2025, U.S. tariffs on Chinese goods had spiked to over 120% on average, and China’s tariffs on U.S. goods exceeded 100% in retaliation. These “triple-digit” tariff rates crippled bilateral trade (China’s exports to the U.S. plunged ~35% YoY in May). | Tariff truce at lower rates: Both sides agreed to roll back tariffs to more moderate (though still elevated) levels. U.S. duties will be fixed at 55% on Chinese imports, while China will cap its tariffs at 10% on U.S. goods. This brings tariff levels down from the extreme highs seen earlier in 2025, effectively reinstating a truce. |

| China’s Rare Earth Export Policy | Export restrictions in place: China had tightened export controls on rare earth elements (and related magnet products) – critical for electronics, EVs, and defense – requiring special licenses and slowing shipments. In April 2025, Beijing leveraged these as a countermeasure, choking off supply and imperiling manufacturers globally. | Rare earth export relief: China agreed to remove or ease restrictions on rare earth mineral and magnet exports. The framework promises that “full magnets and any necessary rare earths will be supplied” to the U.S. up front , alleviating a major supply chain concern. This concession reassures tech and automotive industries that Chinese rare earth supply will resume flowing normally. |

| U.S. High-Tech Export Controls | Expanding tech bans: The U.S. had continued to broaden export controls on advanced technology to China – including cutting off semiconductor design software, jet engine parts, high-end chips, and other dual-use goods. These curbs, justified on national security grounds, were a flashpoint (China saw them as efforts to stifle its tech sector). | Paused/new flexibility: Under the deal, the U.S. signaled it may reconsider or pause some recent tech export restrictions “in a balanced way” alongside China’s mineral concessions. Specifics are scant, but negotiators hinted at potential relaxation of curbs on items like EDA software, jet engine components, and certain chemicals. Notably, top-tier AI chip bans remain intact, and U.S. officials insist there was no explicit “chips-for-minerals” quid pro quo. But the framework opens the door to calibrated easing of tech restrictions if relations improve. |

| Visas & Educational Exchanges | Rising barriers: While visas weren’t a major battleground earlier, the renewed tensions saw the U.S. float curbs on Chinese student visas in 2025, stirring uncertainty for thousands of students and universities. Travel between the countries for business and education had also been hampered by pandemic rules and tit-for-tat visa limitations on journalists and officials. | Visa relief for students: In the framework, the U.S. agreed to allow Chinese students continued access to U.S. universities, reversing the recent visa scare. This olive branch reassures educational institutions and restores a channel of people-to-people exchange. Although not explicitly mentioned, this positive step on student visas suggests a thaw that could extend to smoother issuance of business and research visas, rebuilding some trust through cultural and educational ties. |

As shown above, the framework essentially resets the trade relationship onto a gentler footing without completely eliminating the protective barriers. U.S. Commerce Secretary Howard Lutnick described the deal as putting “meat on the bones” of the earlier Geneva understanding, addressing immediate disputes over rare earths and tech exports. Both sides emerged with face-saving wins: Beijing secured a halt to new U.S. tech sanctions and the prospect of revived student exchanges, while Washington won relief on critical mineral supplies and a cap on China’s retaliatory tariffs.

At 55% and 10% tariffs, the two nations are still far from free trade, but it’s a dramatic comedown from the prohibitively high duties that prevailed just weeks before. In short, the agreement halted a downward spiral and created breathing room for further negotiations.

What’s Missing and Unresolved

Despite its scope, the June 2025 framework is not a comprehensive deal – it leaves many contentious issues on the table. Business leaders should temper their expectations, as several critical topics remain unresolved:

1. Enforcement Mechanisms and Technical Details

The framework is, at best, a political handshake rather than a binding treaty. It offers no published schedule for tariff roll-backs, no quotas for rare-earth exports, and no list of U.S. export controls that will definitely be eased. With no arbitration body—or even a clearly defined verification protocol—compliance rests on goodwill and shifting domestic pressures. In short, the devil still lurks in the fine print that hasn’t been drafted.

2. Timeline Risks and Interim Drift

Negotiators floated 10 August 2025 as the target for a full, enforceable accord, but that date is aspirational. The last interim deal—the Geneva truce in May—unraveled in barely a month, illustrating how quickly momentum can fade. If talks slip past the 90-day consultation window, both governments could revert to escalation simply to regain leverage, leaving exporters stranded in limbo.

3. Structural Fault Lines (IP, Subsidies, Industrial Policy)

None of the structural flashpoints that sparked the trade war—forced tech transfers, state subsidies, dominance of SOEs, or robust IP protections—are addressed in this framework. U.S. grievances over Made in China 2025 subsidies remain; Beijing’s own demands for relief from advanced-chip export bans are likewise unmet. Trade attorneys widely agree that such deep-seated issues will require multi-year negotiations well beyond the scope of this stopgap.

4. Tariffs Still Elevated

Yes, maximum rates fall from crisis levels, but a blanket 55 % U.S. tariff on Chinese goods is historically extreme; many original Section 301 duties (25 % on roughly US$250 billion in imports) stay in force. China’s new ceiling of 10 % is gentler, yet U.S. exporters still pay far more than pre-2018. In practice, this is a ceasefire, not disarmament, and businesses must keep pricing in substantial duty costs.

5. Legal Non-Binding Nature and Trust Deficit

The document still needs final sign-off by Presidents Trump and Xi, and either leader can revise—or abandon—its terms. Trust is scarce: Washington sees unkept Chinese purchase pledges; Beijing views unilateral U.S. tariffs as bad-faith coercion. Without explicit enforcement clauses, any perceived back-sliding could trigger snap-back tariffs or renewed export controls. Vigilant monitoring and constant dialogue will be essential, but history shows that even well-intentioned mechanisms often buckle under political strain.

In summary, the June 2025 framework solves immediate pain points – it averts an all-out trade rupture and addresses acute supply chain fears – but leaves the hard work for later. Exporters and investors should view this as a temporary truce, not the end of the trade conflict. The path to a full deal will require tackling the structural and enforcement challenges that this framework pointedly sidesteps. As the World Economic Forum observed, “deep-rooted tensions continue to fuel selective decoupling” despite this diplomatic thaw. Businesses must plan with one eye on these unresolved issues, as they foreshadow the next rounds of negotiation (or confrontation).

Strategic Implications for Key Sectors

For international companies and exporters, the framework agreement carries varied implications across different sectors. Below we analyze how electronics, electric vehicles, education, and cross-border logistics sectors are affected, and what strategic adjustments may be prudent:

Electronics & Semiconductors

China’s promise to lift rare-earth export curbs removes an acute supply-chain choke—vital for neodymium and dysprosium magnets used in chips, smartphones and EV motors. With 60 % of global output under Beijing’s control, the pledge averts a production freeze in Western fabs and assembly lines. Simultaneously the U.S. may grant case-by-case licences for legacy chip tools and aviation parts, reopening limited but lucrative sales channels. Top-tier AI semiconductors remain barred, so the real upside is in mid-range nodes and mature EDA software.

Electric Vehicles & Battery Materials

The same rare-earth relief secures motor magnets, while China’s tariff cut to ~10 % makes U.S. EVs and components more competitive. A 55 % U.S. duty still blocks low-cost Chinese vehicles, nudging Western OEMs to localise battery supply or re-route parts through FTA partners.

Education & Talent Exchange

Restored four-year student visas signal a soft-power thaw and protect a US $15 bn revenue stream for U.S. universities. Ancillary sectors—ed-tech, housing, test-prep—also benefit. China has yet to reciprocate for U.S. scholars, but momentum could ease business-travel frictions next.

Cross-Border Trade & Logistics

A fixed 55 % / 10 % tariff ceiling ends the whiplash of sudden rate hikes, allowing more predictable freight planning. Importers will still pursue duty-mitigation—bonded zones, FTZs, trans-shipment—while exporters eye a modest revival in China-bound e-commerce.

Opportunities and Strategies for Exporters in the Short and Medium Term

Despite the caveats, the current framework offers a window of opportunity for global companies to advance their China strategies. A more stable trade environment – even if interim – means business decisions can be made under clearer rules. Here are some short and mid-term moves exporters and international businesses should consider:

1. Use the Tariff Truce to Re-enter or Rebalance Trade

With U.S. and Chinese tariffs now capped at 55% and 10% respectively, exporters have a clearer cost baseline. U.S. firms selling to China—particularly in agriculture and premium goods—can re-engage competitively. Importers from China, meanwhile, must factor in permanent high costs but may find niche products still viable. Explore financing options like duty drawback schemes and bank-backed trade credit to ease upfront tariff burdens.

2. Reinforce Supply Chains and Secure Financing

Rare earths and key materials are flowing again. This is the moment to rebuild inventories, renegotiate supply contracts, and stabilize costs. Trade finance conditions are improving banks and export credit agencies may offer better terms now that volatility has eased. Companies should act now to lock in supply security under favorable terms, backed by reliable financing.

3. Rebuild Cross-Border Channels and Partnerships

With tensions cooling, it’s time to revive distribution networks, e-commerce, and JVs in China—especially in consumer, healthcare, and automotive sectors. The 10% Chinese import tariff restores margin potential. Meanwhile, Chinese firms may look for international partners to fill supply chain gaps. Actively seek collaborations and reestablish commercial presence while officials remain receptive.

4. Hedge Against Future Disruption

The truce is real, but fragile. Companies should maintain and refine the diversification strategies developed during the trade war—multi-sourcing, nearshoring, and hedging against currency or tariff risk. Consider bonded warehouses and FTZs to delay duties and stay alert to any changes in export controls or compliance rules. Agility remains critical.

5. Reconnect Talent Pipelines and Mobility Plans

Visa relaxations may signal broader improvements in business travel. Restart executive visits, training rotations, and research collaborations with Chinese partners. Reengage with Chinese universities to recruit skilled graduates and ensure your HR mobility strategy is ready for renewed cross-border operations.

Final Outlook: Act with Clarity, Plan with Caution

Overall, the strategic mantra for exporters now should be: “proceed, but don’t over-commit.” The 2025 framework provides a chance to harvest low-hanging fruit – recapture market share, secure supply lines, and strengthen your cross-border foothold under improved conditions. Wise companies will seize these opportunities while still keeping their safeguards intact.

For exporters and global firms, it’s a floor, not a ceiling: a chance to regain ground lost in years of uncertainty, but not a guarantee of lasting calm.

Gate Kaizen is the trusted partner of large and mid-cap companies as a provider of market entry services and HR Solutions in the Chinese market. We help your business save the outsantding costs of setting up your local entity by leveraging our own structure and the shortcuts of the digital era to minimize the financial risks of expanding overseas. This way, you can focus your attention on what really matters: your business.