China is no longer just the world’s factory. It’s now one of the world’s most dynamic consumer markets.

As global trade patterns shift, particularly following the April 2025 U.S. tariffs on Chinese goods, many international businesses are rethinking their go-to-market strategies. For brands looking to diversify revenue and reach new audiences, selling directly to Chinese consumers through Tmall, Alibaba’s high-end B2C platform, is an increasingly compelling move.

Whether you’re a growing DTC brand or an established player with international ambitions, Tmall Global offers a relatively low-barrier path into China’s digital ecosystem. But success requires more than just opening a storefront. You’ll need a strategic approach, operational readiness, and the right local partner.

This guide breaks down the essentials of selling on Tmall, explains the platform’s structure, and offers a step-by-step roadmap.

Why China, Why Now?

Let’s start with a snapshot of the opportunity:

- Over 800 million online shoppers make China the largest e-commerce market globally.

- E-commerce represents over 50% of China’s total retail sales.

- The Alibaba platform ecosystemholds a combined market share of ~50%.

- In 2024, Singles’ Day generated over $157 billion in sales across Alibaba platforms.

Now factor in the April 2025 U.S. tariffs, which added up to 34% duties on Chinese goods and removed exemptions for small parcels. Many brands now face narrower margins when exporting from China. The strategic response? Sell into China, not just from it.

By reaching Chinese consumers directly, companies can hedge against trade instability, tap into domestic demand, and build brand equity in a high-growth market.

What Is Tmall (and Tmall Global)?

Tmall is Alibaba Group’s premium B2C e-commerce platform where brands can operate official flagship stores. It’s the destination of choice for Chinese consumers seeking authentic, high-quality goods.

There are two key versions of the platform:

- Tmall (Domestic): For companies with a Chinese business entity. Requires inventory inside China, a trademark registered in China and typically offers faster shipping.

- Tmall Global: Alibaba’s cross-border platform, allowing companies without an entity in China to sell directly to Chinese consumers. Goods can be shipped directly from abroad or stocked in China bonded warehouses.

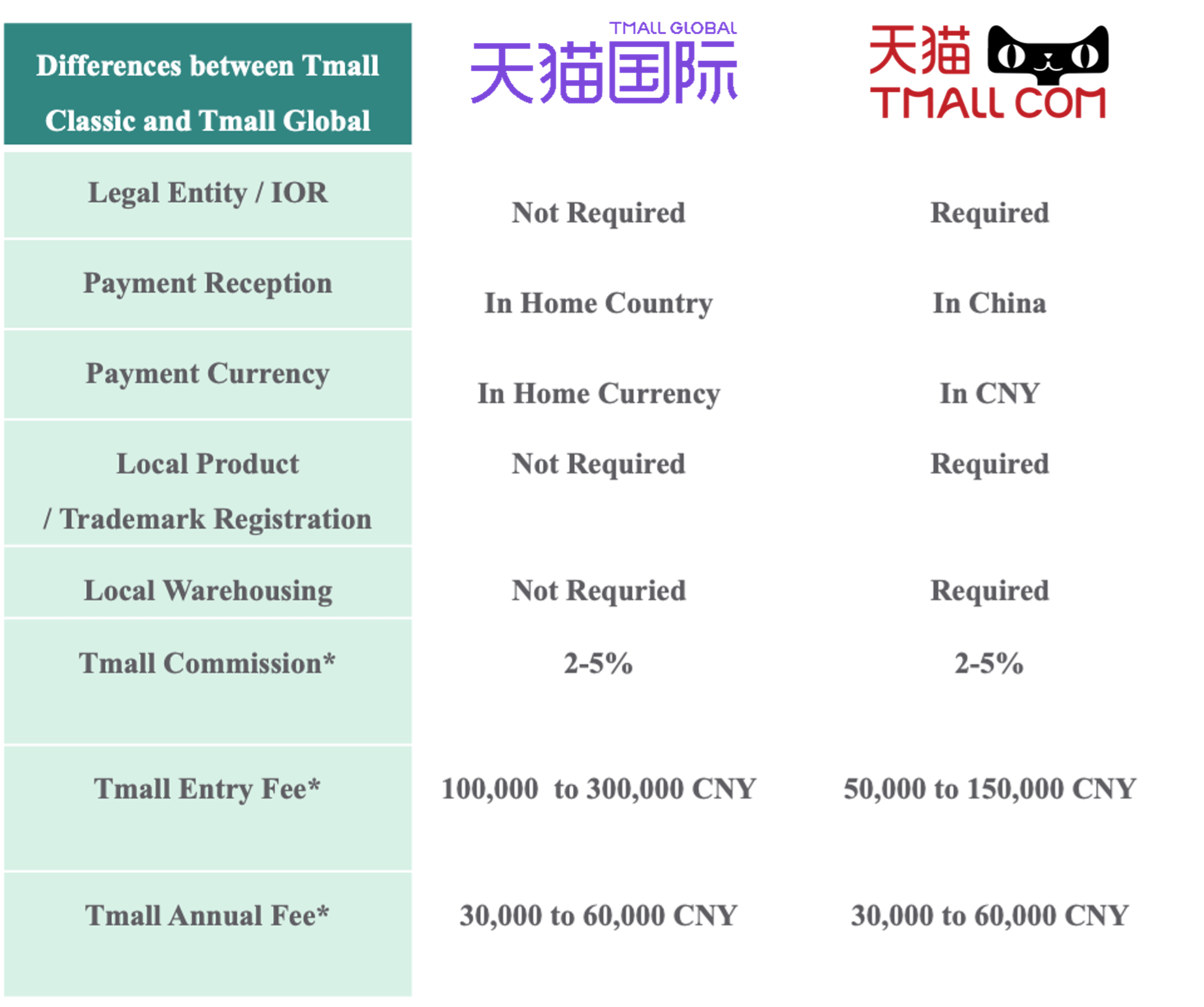

Tmall vs. Tmall Global: Key Differences

For most international brands starting out in China, Tmall Global is the gateway to China. It doesn’t require a Chinese legal presence, and customers are familiar with cross-border shipping and duties.

Tmall Global Vs Tmall Domestic Infographic

Step-by-Step: How to Launch a Store on Tmall Global

1. Determine Eligibility

To sell on Tmall Global, you must:

- Have a legally registered company outside mainland China.

- Own the brand’s international trademark or have exclusive authorization to sell it.

- Be able to provide documents like your business license, trademark certificate, and product origin certificates.

Tmall Global favors brands with a strong track record, ideally at least 2 years of operations and consistent sales in other markets.

2. Choose Your Store Type

There are three main store types:

- Flagship Store: For brand owners with valid trademarks.

- Authorized Store: For distributors with exclusive rights.

- Specialty Store: For multi-brand sellers or retail groups.

For most companies, a Flagship Store is ideal. It communicates authenticity and builds consumer trust.

3. Prepare Documentation

You’ll need:

- Business registration certificate

- Trademark certificate

- Product certificates (e.g. certificate of origin, relevant safety standards)

- Authorization letter (if not the trademark owner)

- Alipay (International) account

- Customer service plan (must include Mandarin-speaking agents)

Tmall expects brands to provide Chinese-language product descriptions, clear return policies, and a local return address (or third-party provider in China or Hong Kong).

4. Apply Through Tmall’s Merchant Portal

The application process is handled online via Tmall Global’s merchant platform. You’ll:

- Submit your documents

- Link your Alipay account

- Choose product categories

- Outline your operations model (bonded warehouse or direct shipping)

Approval typically takes 2–4 weeks. Tmall may request clarifications or additional materials.

5. Pay Fees and Set Up Your Store

Once approved, you’ll be asked to:

- Sign the merchant agreement.

- Pay a refundable deposit (¥50,000–¥150,000 RMB depending on category)

- Pay an annual technical fee (¥30,000–¥60,000 RMB, partially refundable based on sales)

You’ll then need to access Tmall’s Seller Center, where you can upload products, design your storefront, and configure logistics. These must be updated according to the Tmall promotional calendar.

You would ideally need to recruit / hire mandaring speaking designers and store operators to communicate with the Tmall Category manager.

6. Launch and Promote

After publishing your store, it’s time to drive traffic. Success on Tmall depends on:

- In-platform advertising (keyword bidding, display ads)

- External marketing (WeChat, Weibo, Xiaohongshu, Douyin)

- Customer engagement (reviews, livestreaming, loyalty programs)

- Participating in major campaigns like Double 11 and 6.18

Launching without a plan for traffic generation combining the four pathways above, is the fastest path to failure. This is where Tmall Partners (TPs) become essential.

What Are Tmall Partners (TPs)

A Tmall Partner (TP) is a certified service provider that helps brands set up, operate, and grow their Tmall stores. Think of them as your China-based e-commerce operations team.

What TPs Do

- Handle store setup and optimization

- Manage Chinese-language customer service

- Coordinate warehousing and shipping (often via Alibaba’s Cainiao network)

- Run Tmall advertising campaigns

- Engage KOLs (influencers) and manage social channels

- Ensure regulatory compliance and platform updates

Why Most Brands Use a TP

- Language & time zone barrier: You need 24/7 Mandarin-speaking support.

- Complexity of campaigns: Local expertise is key to navigating sales festivals and platform promotions.

- Regulatory risk: A TP ensures you don’t breach local e-commerce or advertising rules.

- Access to data and insights: TPs track performance metrics and adjust strategy in real time.

Most successful foreign brands outsource store operations to a TP, especially in the first 3–5 years.

Sectors With High Demand on Tmall Global (2024–2025)

Based on recent sales data and consumer trends, here are the most promising categories for international brands:

1. Beauty & Skincare

- Huge appetite for foreign beauty brands, especially “scientific skincare” with active ingredients.

- K-beauty and J-beauty remain strong, but niche Western brands are gaining ground.

- Fragrances and male grooming products are growth areas.

2. Fashion & Apparel

- Demand for quiet luxury, athleisure, and sustainable fashion.

- Chinese consumers are highly trend-sensitive and responsive to social media cues.

- Premium pricing must be backed by strong brand storytelling.

3. Health & Wellness

- Supplements, vitamins, and superfoods are booming.

- Trusted origin and ingredient transparency are essential.

- Many consumers prefer Tmall Global over domestic Tmall for health products, due to perceived authenticity.

4. Food & Beverage

- Interest in imported snacks, functional foods, and beverages (especially coffee, dairy, and premium alcohols).

- Regulatory compliance is stricter; ensure labeling and packaging meet cross-border standards.

5. Consumer Electronics

- Brands offering premium features, innovative design, or niche use cases stand out.

- Apple continues to dominate, but there’s space for specialist gadgets and lifestyle tech.

Gate Kaizen: A Strategic Partner for Entering China

One of the biggest hurdles for international companies isn’t just selling on Tmall, it’s navigating the entire China market entry process.

That’s where Gate Kaizen comes in.

Who We Are

Gate Kaizen is a market entry boutique consultancy that helps international brands understand, enter, and easily develop operations in the Chinese market. Our model is built around the Kaizen Ecosystem, a collaborative structure that allows brands to benefit from shared operational resources such as sales teams and office space, significantly reducing the cost and complexity of entering China.

In addition, the Kaizen Ecosystem connects brands with a synergic network of our core team and specialized partner agencies, covering every key area of digital sales support, from platform operations and logistics to content localization and customer service, enabling brands to scale efficiently without the need to set up their own entity in China.

What We Offer

- E-commerce launch support: From documentation to full TP-level services.

- Logistics and warehousing: Gate Kaizen operates bonded warehouse solutions and manages fulfillment.

- Market entry without legal setup: Brands can operate under Gate Kaizen’s legal entity, avoiding delays and costs.

- Boots on the ground: For companies seeking B2B partnerships, Gate Kaizen helps put in place local sales agent networks in market.

- Marketing and compliance support: Including content localization, social media, and e-commerce law guidance.

Why It Matters

Many companies fail in China because they lack local insight, underestimate operational demands, or sign exclusive distribution deals too early. Gate Kaizen’s modular, low-risk model lets brands test the market, gather data, and scale intelligently, with strategic control retained by the brand.

As one client noted:

“Gate Kaizen let us enter China in under 90 days, fully compliant and with a functioning Tmall store — without having to open a subsidiary or hire a local team.”

Gate Kaizen is the trusted partner of large and mid-cap companies as a provider of market entry services and HR Solutions in the Chinese market. We help your business save the outsantding costs of setting up your local entity by leveraging our own structure and the shortcuts of the digital era to minimize the financial risks of expanding overseas. This way, you can focus your attention on what really matters: your business.

Common Mistakes to Avoid

- Assuming China is just another export market.

Localization is not optional. Language, visuals, packaging, pricing, all must be adapted.

- Undervaluing customer service.

Fast, friendly Mandarin-language support is expected. Delays or poor responses hurt reviews, and store’s visibility.

- Neglecting marketing.

Tmall stores don’t generate traffic on their own. Budget for ads, social media, KOLs, and promotions.

- Choosing the wrong TP.

Not all partners are created equal. Assess their knowledge of the market, communication style, and avoid those “one package that fits all cases” type of proposals.

- No long-term plan.

Entering China is a multi-year investment. Brands often see significant returns after the first 12–18 months, not before.

Final Thoughts: Tmall Is a Gateway, Not a Shortcut

Selling on Tmall is not a plug-and-play exercise. It requires careful planning, ongoing investment, and local insight. But for brands willing to do the work, or partner with those who can, the rewards are substantial.

In a world of volatile trade relations and saturated Western markets, China represents an untapped growth horizon. With over 800 million digital-native consumers and an appetite for premium foreign products, it’s a market too big to ignore.

Whether you’re launching your first store or looking to scale, Gate Kaizen offers the strategic support and operational expertise to help you succeed — not just on Tmall, but across the Chinese digital ecosystem.